FTSE 100 Live: Chancellor and banks agree mortgage support; City sees 6.25% interest rates

Consumers are showing signs of resilience after figures today revealed retail sales rose in May.

A separate report by GfK also highlighted optimism on personal finances despite rising mortgage costs and stubborn inflation.

For investors, meanwhile, there was little to cheer today as European markets continue this week’s downbeat performance.

FTSE 100 Live Friday

Retail cheer as sales rose in May

Board exodus at London fintech WorldFirst

Hotel Chocolat shares slide on profit warning

FTSE ends tough week at 7,461.87

Friday 23 June 2023 16:40 , Daniel O'Boyle

The FTSE 100 closed at 7,461.87, down 2.4% for the week.

Stocks fell further today after declines earlier in the week due to higher-than-expected inflation and a half-point interest rate rise.

Ocado was the biggest faller, after a huge rise yesterday on the back of takeover rumours.

What do the mortgage measures agreed on Friday mean for struggling borrowers?

Friday 23 June 2023 16:11 , Daniel O'Boyle

Under-pressure mortgage borrowers have been offered some potential relief as Chancellor Jeremy Hunt and major banks agreed measures on Friday to help ease the pain of rising rates.

Here is a look at what this means for people who are struggling with their mortgage payments:

Heathrow security strikes averted by new pay deal

Friday 23 June 2023 15:18 , Daniel O'Boyle

A long-running dispute involving security officers at Heathrow Airport has ended after workers voted to accept an improved pay offer.

More than 2,000 security officers at Heathrow Terminals 3 and 5 and campus security were due to take 31 days of strike action throughout the summer, but talks resumed which Unite said led to an improved pay offer.

The union said workers will receive an increase of between 15.5% and 17.5%.

The Standard View: Mortgage relief plans are fraught with danger

Friday 23 June 2023 13:55 , Simon Hunt

In politics there are bad ideas, then there are really terrible ideas and, finally, there are mortgage relief schemes at a time of soaring inflation.

Such a policy would, as Chancellor Jeremy Hunt himself has admitted, make the current situation “worse, not better”. And yet, opportunists can sense their moment.

Jeremy Hunt agrees measures with banks aimed at cooling mortgage crisis

Friday 23 June 2023 13:32 , Daniel O'Boyle

Chancellor Jeremy Hunt has agreed measures with lenders aimed at helping mortgage holders struggling with high interest rates but has resisted offering Government support.

After summoning banks and building societies to Downing Street to help quell the crisis, Mr Hunt said they agreed to implementing a 12-month minimum before repossessing homes.

Boxpark wins planning permission for Boxhall City food hall at Liverpool Street

Friday 23 June 2023 12:26 , Daniel O'Boyle

“Pop-up mall" operator Boxpark has won planning permission to open Boxhall City, its first London food hall at the Metropolitan Arcade building near Liverpool Streetstation.

The site, set to open in summer 2024, would include 16 pop-up restaurants. Boxpark CEO Simon Champion told the Standard his team would scour London street food markets to find vendors.

Champion said:: “We are delighted to receive the news today that Boxhall City has planning approval, as we aim to revive the Metropolitan Arcade building whilst retaining its unique character. Our team has worked extremely hard to secure this incredible central location in the City, and we are very excited about creating an all-day social dining destination to cater for hungry City workers, local residents in the neighbourhood, as well as attracting tourists and helping to drive footfall into the area.”

City voices: It’ll take a recession to beat inflation

Friday 23 June 2023 12:24 , Daniel O'Boyle

“Events this week have bolstered my view that high inflation won’t disappear on its own,” writes Paul Dales of Capital Economics.

“Yesterday’s 0.50% rise in interest rates from 4.50% to 5.00% shows that the Bank of England is realising this.

“Even so, I suspect the Bank will have to generate a recession to break the back of inflation.”

Market snapshot as short-dated gilts surge past Monday’s 15-year high

Friday 23 June 2023 11:51 , Daniel O'Boyle

Two-year gilts surged past the levels reached on Monday to a new 15-year high.

That comes as City traders up their bets on interest rates peaking at 6.25% or even 6.5% by early next year,, which is now seen as a greater than three-in-five possibility.

Take a look at all the key market data

Short-dated gilt recovery erased

Friday 23 June 2023 11:26 , Daniel O'Boyle

Two-year gilt yields fell back down tin early trading, in a move thhat would appear to calm mortgage holders whose fixes are soon to expire, but a late-morning surge has taken yields back towards 15-year highs once again.

The two-year gilt was yielding 4.93% around two hours ago, but traders have sold again on the back of the latest PMI figures, sending yields back towards 5.08%.

That could mean more pain for mortgage holders, as the gilt market is typically used to price fixed-rate deals.

Private sector growth slower than expected in May

Friday 23 June 2023 10:42 , Daniel O'Boyle

The UK private sector grew in May, but more slowly than expected, according to a closely watched indicator.

The S&P Global / CIPS Flash UK PMI came to 52.8 in May, below April’s figure as well as economists’ expectations. Any figure above 50 represents growth.

The services sector continued to grow, albeit more slowly, while manufacturing’s decline continued.

Dr John Glen, CIPS Chief Economist said: “Recent interest rate rises will also add more stress on business investment. In the manufacturing sector, new orders fell again for another month, marking a year of shrinking workflows. Customer spending in the second half of 2023 is likely to shrink further as concerns over the UK economy gather pace with stretched affordability rates amongst consumers and businesses alike.”

European services weakness adds to FTSE pressure, Ocado shares fall back

Friday 23 June 2023 10:29 , Graeme Evans

Europe’s darkening economic picture today added to the pressure on the FTSE 100 index.

The latest bout of selling followed a worrying batch of PMI activity indicators, including worse-than-expected readings from France and Germany’s service sectors.

Risk appetite was already low after yesterday’s surprise 0.5% interest rate hikes in the UK and Norway and the hawkish comments by Federal Reserve chair Jerome Powell concerning America’s inflation fight.

From 7642 at Monday’s opening bell, the FTSE 100 index today stood at 7489.52 after shedding another 12.51 points at the end of Europe’s worst week since the banking turmoil in the spring.

The Brent Crude price fell 1.8% to $72.79 a barrel, extending the 3% decline seen yesterday as global recession fears sharpened on the outlook for more rate rises.

BP slowed 3.75p to 456.25p and Shell eased more than 1% or 27p to 2306.5p, alongside more heavy losses in the housebuilding sector.

Berkeley Group fell more than 3% or 118p to 3754p after analysts at HSBC cut their recommendation to “reduce” with a target price of 3000p.

Persimmon and Barratt Developments also declined 25p and 7.5p to 1078.5p and 410.8p respectively as traders further reduced their exposure as mortgage bills continue to rise.

Elsewhere, excitement over a potential takeover of Ocado faded after the technology stock’s jump of 32% yesterday. The speculation focused on Amazon but UBS said it was hard to see the rationale for a move by the tech giant or other grocery companies.

Shares in the M&S retail partner today fell back 8% or 48p to 519.8p as the worst performing blue-chip.

In another tough week for mid-cap investors, the FTSE 250 index retreated 0.4% or 65.51 points to 18,262.46. Stocks down by more than 2% included Redrow and Crest Nicholson, with holidays giant TUI 3% or 17p lower at 556p.

Audioboom shares crash after profit warning

Friday 23 June 2023 10:24 , Daniel O'Boyle

Shares in AIM-listed podcast marker Audioboom plummeted today as it warned “challenging” advertising markets would hit its profits for the year.

Audioboom said its “operational KPIs” were still up, but poor ad sales meant its revenue and profits would miss expectations.

The group has also “adjusted the approach” it takes in its agreements with podcasters, in order to safeguard against continued low sales.

Audioboom, which produces podcasts including Never Thought I'd Say This and What Makes a KIller, said it was in a “strong position to fully exploit” an improvement in market conditions when that does occur.

Shares were down 26.6% to 207.5p this morning. They are down more than 80% in the past year.

Mortgage prices close to unchanged but more lenders pull products

Friday 23 June 2023 10:08 , Daniel O'Boyle

There was little movement in fixed-rated mortgage prices this morning, with both two-year and five-year fixed rates close to flat.

The average price of a two-year fix was unchanged at 6.19%, while five-year rates were cllose to flat at 5.83%.

The number of products on the market, though, fell by another 60, bringing the total decline in mortgages available to almost 1,000 in the past month.

Gilt yields eased today, which could suggest that upcoming mortgage pain might not be as bad as previously feared.

Hotel Chocolat shares slide on profit warning

Friday 23 June 2023 10:06 , Simon Hunt

Hotel Chocolat left investors with a bitter taste today after the upmarket confectioner issued its second profit warning in two months, sending its stock down by almost 15%.

The 125-store chain said its cost-cutting plan was taking longer than expected, meaning it would make a loss for 2023. It had been expected to make a profit of about £0.3 million. It also cut its outlook for 2024, due to inflation eating into hard-pressed consumers’ spending. The brand’s “Classic Cabinet” product, a “two-tier showcase” of 61 chocolates, costs £65.

Hotel Chocolat, founded by entrepreneur Angus Thirlwell, last warned on profits on April 27 after logistical problems meant it was late getting its Easter range into shops.

It opened its first boutique in north London in 2004 and listed on the stock exchange in 2016. The shares fell 19p to 123p today.

GSK shares lifted after out-of-court settlement reached on cancer claim

Friday 23 June 2023 09:01 , Simon Hunt

GSK today sought to call time on a long-running legal dispute over whether one of its drugs could cause cancer by reaching an out-of-court settlement with one of the claimants.

The pharma giant said it had reached a deal with James Goetz, who had claimed that its heartburn drug Zantac caused cancer. The move means a case he filed in California state court, set to begin trial in July, would be dismissed. Details of the settlement were not given. Shareholders reacted positively to the deal, with the stock up 5.4% to 1,432p.

GSK said the settlement “reflects the company’s desire to avoid distraction related to protracted litigation in this case. GSK does not admit any liability in this settlement and will continue to vigorously defend itself based on the facts and the science in all other Zantac cases.”

Housebuilders struggle as FTSE 100 falls, GSK 3% higher

Friday 23 June 2023 08:31 , Graeme Evans

Pressure from the housebuilding sector amid expectations of further interest rate rises has contributed to the FTSE 100 index falling 24.73 points at 7477.30.

Berkeley Group fell more than 5% or 213p to 3659p after analysts at HSBC cut their recommendation to “reduce” with a target price of 3000p.

Persimmon and Barratt Developments also fell by more than 3%, down 37.5p and 12.8p to 1066p and 405.5p respectively.

Drugs giant GSK led the FTSE 100 risers board after settling a lawsuit related to Zantac in California. Its shares rose 46.8p to 1405.8p, while GSK’s former consumer healthcare arm Haleon improved 4p to 329.05p.

The FTSE 250 index fell 56.98 points to 18,270.99, with shares in Bellway, Vistry, Redrow and Crest Nicholson all down by more than 2%.

Key market data as FTSE opens lower

Friday 23 June 2023 08:24 , Daniel O'Boyle

The FTSE 100 started lower today amid continued worries about the effects of higher interest rates.

Take a look at today’s market snapshot.

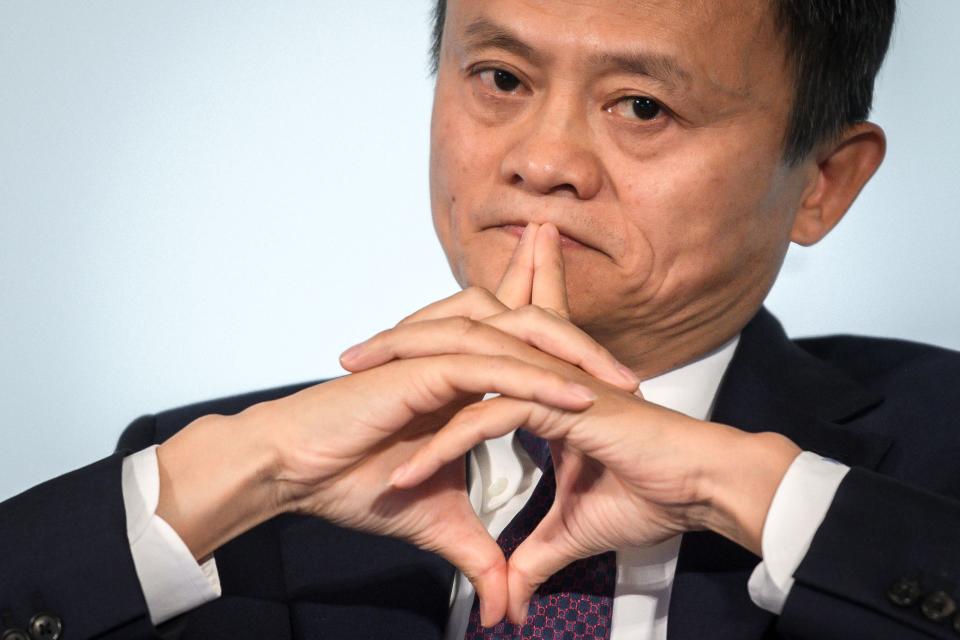

Board exodus at London fintech WorldFirst

Friday 23 June 2023 07:56 , Simon Hunt

London fintech WorldFirst has seen a mass board exodus as billionaire Jack Ma tightens his grip on the management of the payments company, the Standard has learnt.

A suite of senior leaders have left the firm over the past year, including its CEO, finance director, managing director and UK country manager.

Senior members of the company’s risk and legal team have also left, including its head of risk, chief information security officer, and group general counsel and compliance officer.

Staff at the fintech’s parent company, Ant Financial, as well as its sister company, Chinese payments platform Alipay, have been among those brought in to replace the departing execs and managers.

Founded in London in 2004, WorldFirst was acquired by Jack Ma’s Ant Group in 2019 in a deal thought to be worth more than $700 million (£550 million).

‘Too soon’ to rule out recession, top economist warns

Friday 23 June 2023 07:47 , Daniel O'Boyle

Ruth Gregory, deputy chief UK Economist at Capital Economics said that while the better-than-expected UK retail sales figures released this morning provide some confidence, they still don’t change her expectations of a recession this year.

“The further rebound in retail sales volumes in May suggests the recent resilience in economic activity hasn’t yet faded,” she said. “But we think it’s too soon to conclude the rebound in retail sales will be sustained and the economy will avoid a recession.

“Overall, the figures were far better than we had expected. But our view is still that the growing drag on activity from higher interest rates will eventually tip the economy into recession, generating a 0.5% peak to trough fall in real consumer spending.”

Consumer confidence improves in June

Friday 23 June 2023 07:27 , Graeme Evans

Consumer confidence continues to pick up despite higher mortgage costs and stubborn price pressures, GfK’s monthly survey revealed today.

GfK’s overall index score edged up three points to -24 in June, the fifth monthly rise in a row and better than the score of -41 seen the same month last year.

The biggest surprise in the report concerned how people see their personal financial situation in the coming year, which improved seven points to a whisker from positive territory.

GfK’s client strategy director Joe Staton said: “Consumers are showing remarkable resilience in the face of inflation that is currently refusing to yield.

“This is the best showing for the overall index score for the past 17 months and, if consumers continue to weather the current economic storm, then this will provide a firm foundation for getting back to growth.”

European markets under pressure after big rate rises

Friday 23 June 2023 07:15 , Graeme Evans

European markets are set for another session in the red as worries mount that recessionary conditions will be needed to bring inflation back under control.

The FTSE 100 index finished 0.8% lower last night and is forecast by CMC Markets to open down another 27 points at 7475 in this morning’s session.

It follows the surprise moves in the UK and Norway to increase interest rates by 0.5%, with Deutsche Bank reporting that markets see a 70% chance of another half point move at the Bank of England’s next meeting in early August.

The peak for UK interest rates is now seen at 6.25%, the highest since the 1990s.

A rally late in the US session helped the S&P 500 inde to post a gain of 0.4% but US futures are pointing lower when trading resumes later today.

Technology and mega-cap stocks outperformed the rest of Wall Street yesterday, resulting in a rise of 4% for Amazon and lifting the Nasdaq Composite by almost 1%.

Bank holidays and good weather boost retail sales in May

Friday 23 June 2023 07:03 , Daniel O'Boyle

Three bank holidays and a run of good weather helped to boost the UK retail sector in May, with sales up another 0.3%.

That’s well ahead of the 0.2% decline predicted by economists.

Sales had already grown in April, after a poor performance in March, though the growth rate was down from April’s 0.5%.

The extra bank holiday for the King’s jubilee, alongside the two regularly scheduled days off, contributed to the strong sales, as did good weather.

High street retailer Next had already suggested that May could be a strong month for retail, when it revealed its profit during the late spring was ahead of expectations and upped its full-year guidance as a result.

Recap: Yesterday’s top stories

Friday 23 June 2023 06:50 , Simon Hunt

Good morning. Here’s a summary of our top stories from yesterday.

The Bank of England surprised City analysts with a 0.5% interest rate rise.

Shares in Ocado soared 40% amid speculation Amazon was preparing a takeover offer.

The competition watchdog blocked a merger between hearing implant firms.

Yahoo Finance

Yahoo Finance