Capital gains tax revamp could hit three times more people

Three times as many people will have to pay capital gains tax under plans to pay for the cost of the pandemic put forward by the Government's official tax adviser.

The Office for Tax Simplification (OTS) has suggested increasing tax rates, slashing personal allowances and passing bills down the generations in a move which could raise more than £18 billion a year.

The advisers suggested a massive overhaul of capital gains tax (CGT) could triple the number of people hit by the duty as ministers scramble to slash the country's spiralling Covid-19 debts.

The news will stoke further fears of an impending tax squeeze on the wealthy to help pay for the UK's coronavirus response in the next Budget.

The Government is desperately seeking ways to push down Covid-19 debts, with the deficit forecast to hit almost £400 billion, or 20 per cent of GDP, this year alone.

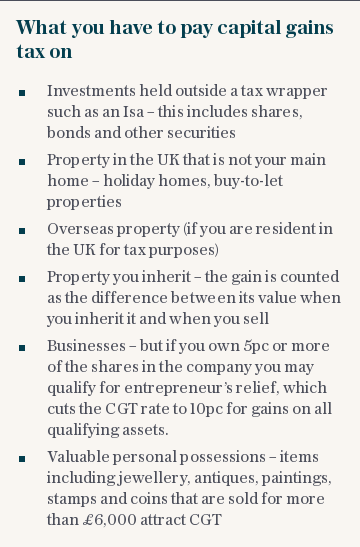

If adopted by the Government, the changes could mean hundreds of thousands more taxpayers are charged higher rates on profits they make from selling investments and second homes.

Rishi Sunak, the Chancellor of the Exchequer, commissioned a review into CGT in July to assess whether the current system is still fit for purpose.

The OTS concluded that current rates are too complex, adding that if the Government wants to increase taxes, it should bring them closer in line with the rates of income tax.

This would clamp down on wealthier individuals who pay less because they sell small chunks of an investment portfolio for regular income, it said.

The OTS stressed it is not calling for higher taxes as setting rates is Government policy.

CGT is currently charged at 10 per cent and 20 per cent for most taxable assets, or 18 per cent and 28 per cent for residential property that is not a main home.

Income tax is charged at rates of 20 per cent, 40 per cent, and 45 per cent.

The Institute for Public Policy Research think tank has estimated the Government could raise an additional £90 billion over five years if CGT and income tax rates were harmonised.

The OTS also proposed slashing the £12,300 annual tax-free allowance on CGT.

Lowering the tax break to £5,000 would double the number of people who pay the tax, it said. Reducing it to £1,000 would almost triple the number and mean many more people would have to file annual tax returns.

More than 275,000 people paid a total of £9.5 billion in CGT in 2018-19. Two fifths of the tax take came from wealthy individuals making gains of £5 million or more.

By contrast, some 30 million people pay income tax, which raises close to £200 billion annually.

A spokesman for the Government said it would consider the review and said its priority right now is supporting jobs and the economy over winter.

The Telegraph website is celebrating its 26th birthday and offering readers a special subscriber offer. If you sign up today, you will pay just £1 per week for your first six months. Take advantage of the offer here.

Yahoo Finance

Yahoo Finance