Investment banks radically scaling back estimates of Brexit job losses

Estimates of the number of UK banking jobs that will be lost as a result of Brexit have been radically scaled back, new research shows.

Investment bank Nomura said in a major Brexit note sent to clients this week: “The largest investment banks continue to decrease the amount of projected employee relocations.”

In total, Nomura said it now expects 10,000 UK financial services jobs to be at risk of relocation due to Brexit. That is double the Bank of England’s estimate for “Day One” job losses but well below earlier estimates from consultancies such as Oliver Wyman and EY. Reuters estimated in September that just 630 roles had been relocated as a result of Brexit.

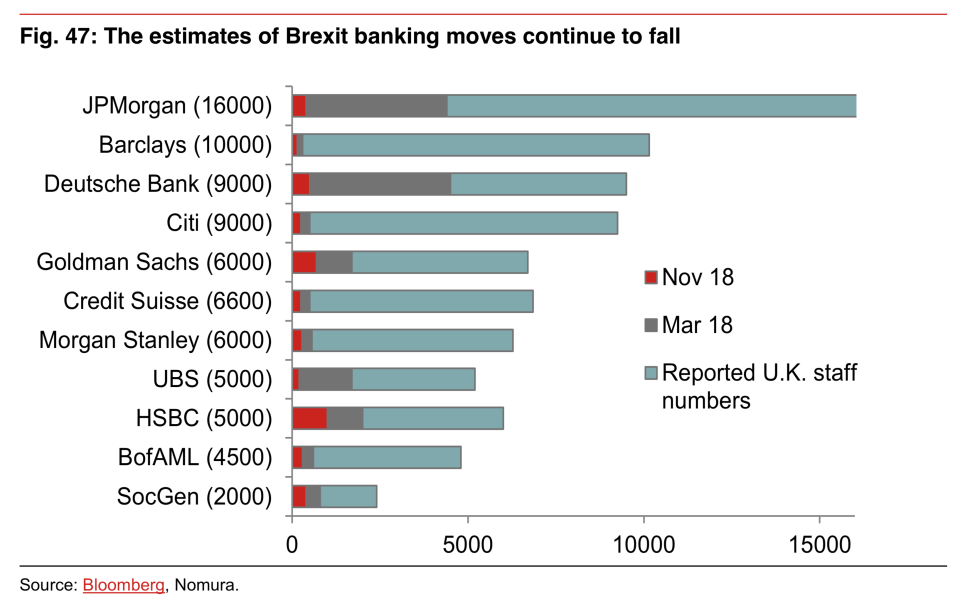

Nomura produced the below graphic showing that planned relocations of jobs as a result of Brexit are now forecast to be in the hundreds for most big banks, down from estimates of thousands in some cases.

In the case of JPMorgan and Deutsche Bank, estimates of job losses have been radically scaled back.

JPMorgan CEO Jamie Dimon warned at the start of 2018 that as many as 4,000 jobs could be moved out of the UK as a result of Brexit. However, a representative for the bank told MPs in September that initial job moves due to Brexit would be “in the hundreds,” although he warned it could become “substantially larger” over time.

The EU’s passporting rules allow financial companies registered in EU countries to use their local licenses to trade across the bloc. Once the UK leaves the EU, financial services companies will be unable to use UK licenses to serve EU clients from London. Firms have therefore been relocating jobs and applying for new licenses to ensure they can continue to serve clients.

“UK-based financial institutions have looked to minimise the expense and disruption for “Day 1” of Brexit for relatively little cost, such as applying for EU banking licences,” Nomura said. “As of November 2018, 25 banks had concluded or are close to finishing applications for EU subsidiaries, compared with fewer than 10 a year earlier.”

Nomura said in its note that banks could be forced to move more jobs overseas if there is a no deal Brexit.

“It should be noted, however, that the outlined measures are still unlikely to mitigate the overall impact of a “no-deal” scenario and the final terms of Brexit will be critical for the strategy of financial sector,” the investment bank said.

The former CEO of the London Stock Exchange has warned that as many as 200,000 UK financial services jobs could be lost longterm in the event of a disruptive Brexit.

———

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

This chart shows the EU countries most reliant on trade with the UK

Bank of England head: China’s renminbi could one day rival the dollar as the world’s currency

What a second Brexit referendum might look like

The trial of the ‘Barclays Four’ starts this week — here’s what you need to know

Yahoo Finance

Yahoo Finance