All over Europe, people have suddenly stopped buying cars

We suddenly stopped buying cars.

All over Europe, new car sales are suddenly down. Not a little bit, a lot. The shift suggests consumers are uncertain about their economic prospects in the near term.

In the UK, registrations of new cars dipped 28.4% in April following a change in vehicle excise duty (VED) the month before. The increase in VED tax accelerated some purchases and delayed others, but the April slump was greater than the March bump, as this chart from Pantheon Macroeconomics shows.

Pantheon Macroeconomics

In the UK, consumer confidence roughly tracks new car registrations:

Pantheon Macroeconomics

At any other time that might be brushed off as a fluke — after all, the UK is going into Brexit, and the VED change may have worried some consumers.

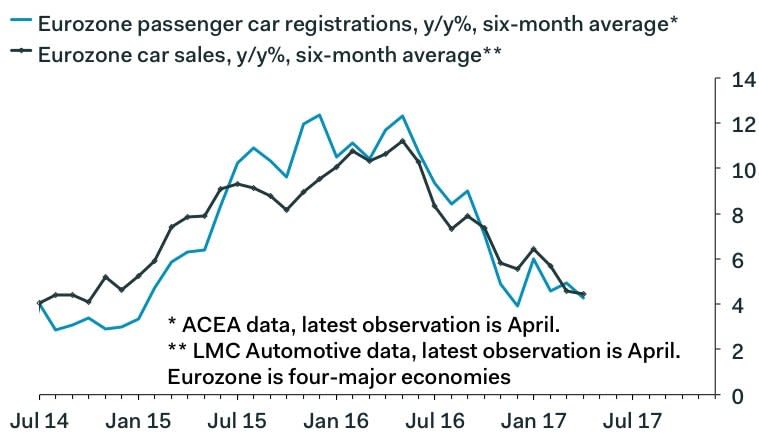

But a similar picture is happening across Europe:

New car registrations in the 27 EU countries fell 6.6% year-over-year in April, according to Pantheon. They had risen 11.2% in March.

In the core Eurozone countries, new registrations fell 5.1%, down from a 11.5% increase in March, Pantheon said.

New registrations in France declined 6.0%.

Germany went down 8.0% year-over-year.

Italy was down 4.6%.

Pantheon Macroeconomics

The downturn in the data was compounded by a decline in dealer registrations, suggesting that part of the slip was due to a lack of cars to buy. The data is also choppy, and you can expect a rebound next month.

Nonetheless, in terms of the underlying trend, it's "a grim start to Q2 for the European car sector. Growth mainly was pegged back by weakness in the major economies," Pantheon analyst Claus Vistesen told clients. "This is the first year-over-year fall in EU 27 car registrations since 2013, which corroborates our story that consumers’ spending will lose momentum this year as inflation eats into real wages."

Diesel cars are particularly hard hit, as consumers recoil from vehicles they were told years ago were better for the environment but have turned out to be worse. This chart, from Barclays, tracks diesel's market share. The fuel was going into decline as an engine choice before the Volkswagen emissions scandal (although the scandal accelerated the decline):

Barclays

"On an absolute basis, and partly due to the decline of the wider market, diesel volumes dropped by more than 90k units," Barclays analysts told their clients.

What's going on? Tough to say, but it doesn't feel good. GDP growth is broadly up across the continent but there's also a lot of political uncertainty: Italy will hold elections soon and the 5 Star Movement is likely to win — that party wants Italy to leave the euro. No one knows whether Britain's exit from the EU will be soft or hard.

It would be one thing if the weakness was only in Italy, Spain or Greece. But the most worrying part is how bad it is in the UK, Germany, and France — the economic engines of Europe.

It is probably inflation.

Prices are rising, especially in the UK where a weak pound is driving prices up faster than wages. That is making everyone feel poor, as Bank of England governor Mark Carney said last week: "The wages people are getting are not going to be sufficient to compensate for the rises in consumer prices, prices in the shop."

NOW WATCH: Crocs has a new comeback plan — here's why it could actually work

See Also:

Yahoo Finance

Yahoo Finance