The UK areas where house prices are rising the most

UK house price growth is running at a two-and-a-half year high at 3%, with record high sales agreed due to a surge in demand post-lockdown.

Northern cities are leading annual house price growth, with the highest growth rate in Nottingham where prices are up by 5.1%, according to Zoopla’s monthly house price index.

This is followed by Manchester, with an increase of 4.6%, and Leeds where prices are up 4.5%.

With demand continuing, this growth is expected to continue for the next two to three months and could peak at 4% by the end of the year, according to Zoopla.

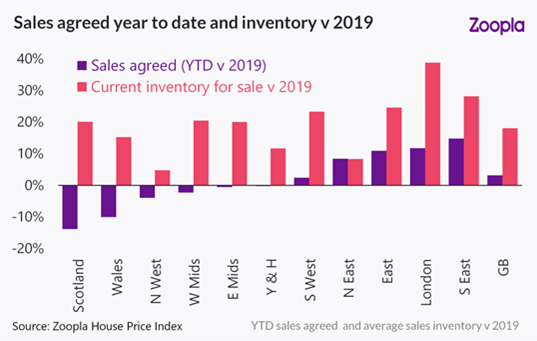

Regionally, the South East of England and London are seeing the greatest rise in agreed sales. This is partly due to the market recovering off a low base in these regions. Sales agreed year to date are up by 15% in the South East, compared to the UK average of 3%, followed by London and the East of England which are up by 12% and 11% respectively.

“Last year sales volumes in southern regions were 20% lower than in 2015, which is why the rebound in demand has boosted sales so much in southern England,” Zoopla said.

READ MORE: Coronavirus pandemic shifts London property hotspots on tube lines

The number of homes for sale across the UK is up 18% on last year, at higher average asking prices — the median price of a home is 10% higher than in 2019, according to Zoopla.

London has experienced the biggest increase in the supply of new homes coming to the market, up 39% compared with this time last year.

WATCH: Why are house prices rising during a recession?

Nick Leeming, chairman of estate agency Jackson-Stops, said: “This certainly reflect what we’re seeing on the ground with sales agreed last month amongst the highest on record across the Jackson-Stops network.

“Whilst there has been a notable uptick in activity across every branch, this has been particularly prevalent in the South East, with Chichester and Dorking featuring amongst the locations which saw the highest volume of new offers on properties.”

READ MORE: UK house price growth hits two-and-a-half-year high

Sales activity across the UK is becoming more polarised, according to analysis by Zoopla, with a recent drop in sales in less wealthy demographics due to growing economic uncertainty and reduced credit availability. In comparison sales are surging in wealthier areas that are less-mortgage reliant and have more property equity.

This is due to economic pressures resulting from COVID-19, with recession and rising unemployment impacting parts of the housing market, while this is being masked by strong market conditions in other areas, according to Zoopla.

Watch: What is shared ownership?

Yahoo Finance

Yahoo Finance