Those who invested in Build-A-Bear Workshop (NYSE:BBW) three years ago are up 268%

It hasn't been the best quarter for Build-A-Bear Workshop, Inc. (NYSE:BBW) shareholders, since the share price has fallen 15% in that time. But that doesn't change the fact that the returns over the last three years have been very strong. Indeed, the share price is up a very strong 247% in that time. So the recent fall in the share price should be viewed in that context. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Build-A-Bear Workshop

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

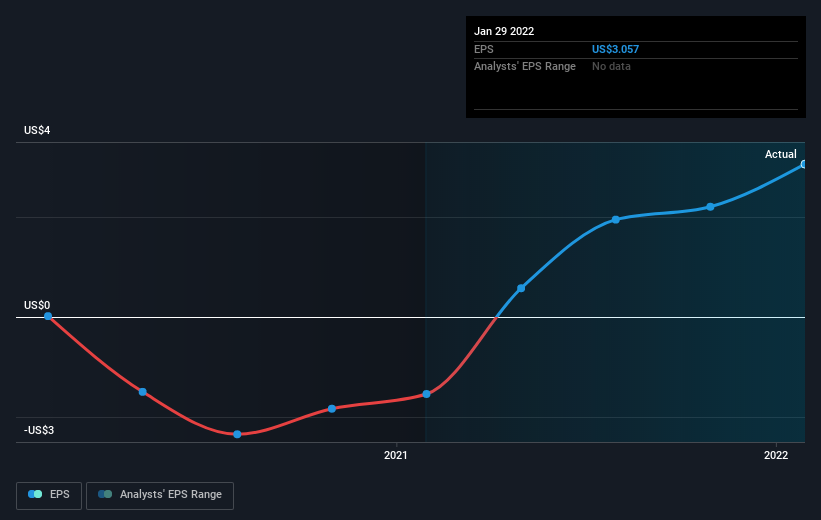

Build-A-Bear Workshop became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Build-A-Bear Workshop has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Build-A-Bear Workshop's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Build-A-Bear Workshop's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Build-A-Bear Workshop hasn't been paying dividends, but its TSR of 268% exceeds its share price return of 247%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Build-A-Bear Workshop shareholders have received a total shareholder return of 26% over one year. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Build-A-Bear Workshop (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance