5 Growth-Rated Nasdaq-Listed Tech Stocks to Pick Right Now

The stock market has been in a recovery mode since April after bottoming out in late March due to the pessimism surrounding the coronavirus pandemic. Investors are hoping that the worst of the pandemic is almost over and the economy will swing back to a recovery mode on the government’s easing restrictions. Optimism over a potential vaccine for COVID-19, along with an uptick in economic activities and an improving job market, has also reinstated investor confidence.

The technology sector played a key role in the quicker-than-expected recovery of the stock market. The year-to-date (YTD) loss of Dow Jones has contracted to 2.7% from 23.2% as of Mar 31. The Nasdaq Composite and the S&P 500 indexes’ YTD returns have even turned to +24.3% and +4%, respectively, from -14.2% and -1.9% as of Mar 31.

The Technology Select Sector SPDR XLK, the most important component of the broad market index, has appreciated 43.9% since April. Moreover, the ETF has a positive year-to-date return of 26.1%, outperforming all the three major U.S. indexes.

Among the Nasdaq’s 100 components, 72 stocks have registered positive year-to-date returns, of which 37 are from the Computer and Technology sector.

What’s Driving the Tech Sector Rally?

The technology sector has been robustly resilient to the negative impact of the pandemic-induced disruptions, aided by advanced technologies, including Artificial Intelligence (AI), Machine Learning (ML), Augmented Reality (AR), cloud computing, blockchain and robotics.

The adoption rate of Internet-based services and apps has been increasing rapidly as people are compelled to stay indoors. Also, the global work-from-home wave is bolstering demand for advanced technology-based virtual meetings and conference tools.

Additionally, the work-and-learn-from-home necessity has propelled demand for PCs, notebooks, peripheral accessories, and cloud storage. All of these, in turn, are fueling growth for high-speed Internet services.

Moreover, the rising demand for robust communication networks is another positive. Further, the growing proliferation of AI technology, and cloud computing products and services in managing this pandemic situation is a tailwind. All these trends are stoking demand for semiconductor chips.

In addition, the long-term growth prospects of tech companies look promising owing to the continued digital transformations. The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur further growth. Apart from this, blockchain, IoT, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

What Should Investors Do?

Considering the healthy growth prospects of tech companies, it makes sense to invest in this space for long-term gains. Amid this economic and financial instability, it is a prudent idea to pick solid growth companies as these are financially stable, reaping profits in established markets. These stocks, with their healthy fundamentals, help investors hedge their investments from any economic downturns.

Furthermore, the technology sector is likely to benefit the most from the reopening of the U.S. and global economies after two-three months of partial or full lockdowns that were imposed to prevent the spread of coronavirus.

Here, we have zeroed in on five Nasdaq-traded tech stocks that are well poised to benefit from this space’s solid growth prospects.

These stocks also have favorable combinations of a Growth Score of A or B, and a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks’ proprietary methodology, stocks with such favorable combinations offer solid investment opportunities.

Our Picks

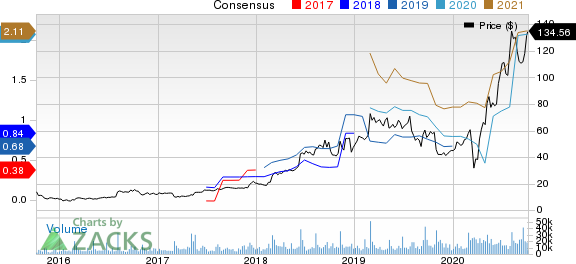

Zoom Video Communications ZM continues to add a record number of subscribers and expand its enterprise customer base amid the pandemic-induced remote-working and online-learning wave. Easy to deploy, use, manage and solid scalability make Zoom Video’s software popular among customers.

Moreover, this Zacks Rank #1 company’s efforts to eliminate the security and privacy loopholes, and the new hardware and Zoom From Home solution’s launch are expected to help expand the clientele. Additionally, per a report from Global Market Insights, the global video conferencing market is expected to go beyond $50 billion by 2026.

The Zacks Consensus Estimate for fiscal 2021 earnings moved 4.9% north to $2.37 per share in the past 30 days. The stock has Growth Score of A.

Zoom Video Communications, Inc. Price and Consensus

Zoom Video Communications, Inc. price-consensus-chart | Zoom Video Communications, Inc. Quote

Dropbox DBX has been gaining from the evolving workspace demands for seamless enterprise communication tools.

The company offers a platform that enables users to store and share files, photos, videos, songs and spreadsheets. Solid demand for cloud storage, triggered by the coronavirus crisis-led work-from-home wave, has been acting as a tailwind for this Zacks Rank #1 company.

Additionally, integration with leading applications like Zoom Video, Slack and Atlassian are likely to expand the Dropbox paying-user base over the long run.

The Zacks Consensus Estimate for 2020 earnings has been revised 4.1% upward to 77 cents per share in the past 60 days. The stock has Growth Score of B.

Dropbox, Inc. Price and Consensus

Dropbox, Inc. price-consensus-chart | Dropbox, Inc. Quote

Etsy ETSY is benefiting from the growing Marketplace and Services revenues. Solid momentum across active sellers and buyers is a major positive. Moreover, enhancements in search and discovery are fueling momentum among buyers. The robust Etsy ad program is also aiding seller base growth.

Apart from these, the COVID-19-induced e-commerce boom and surging mask sales are tailwinds. Also, the company is witnessing solid traction among reactivated buyers, which is contributing significantly. Benefits from the Reverb buyout are other positives. Etsy currently sports a Zacks Rank #1 and has a Growth Score of B.

The Zacks Consensus Estimate for the current-year earnings is pinned at $2.07 per share, having been revised upward by 2 cents in the past 30 days.

Etsy, Inc. Price and Consensus

Etsy, Inc. price-consensus-chart | Etsy, Inc. Quote

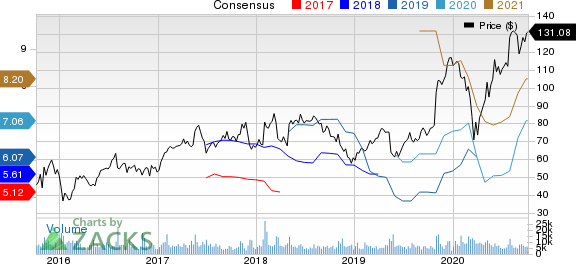

Qorvo QRVO has been riding on the increasing demand for 5G smartphones, as well as robust improvement in the Infrastructure and Defense Products business. Solid uptake of Bulk Acoustic Wave (BAW) filters, as economies have started to reopen, is anticipated to boost the top line.

Further, an expanding portfolio of 5G base solutions amid the accelerated deployment of 5G bodes well. Also, the growing momentum for Qorvo’s Gallium Nitride (GaN) technology-based solutions is a positive. Improving iPhone sales despite the coronavirus outbreak is a tailwind for this Zacks Rank #1 company.

Qorvo has a Growth Score of B. The consensus mark for its fiscal 2021 earnings is $7.06 per share, having moved up 7% in 30 days’ time.

Qorvo, Inc. Price and Consensus

Qorvo, Inc. price-consensus-chart | Qorvo, Inc. Quote

Synaptics SYNA is well poised to capitalize on its market-leading position for both touchpads and secure fingerprint sensors amid the upbeat trends in PC shipments.

Furthermore, increasing adoption of the company’s edge SoCs integrated with AI, and embedded neural network capabilities for smart video and audio devices is stoking top-line growth. Additionally, the acquisition of Broadcom’s (AVGO) wireless IoT connectivity business (Jul 23) and the buyout of DisplayLink (Jul 31) have fortified Synaptics’ portfolio offerings.

The Zacks Consensus Estimate for fiscal 2021 earnings has been revised 7.3% upward to $6.33 per share in the past 30 days. The stock currently carries a Zacks Rank #2 and has a Growth Score of A.

Synaptics Incorporated Price and Consensus

Synaptics Incorporated price-consensus-chart | Synaptics Incorporated Quote

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Etsy, Inc. (ETSY) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News