Is a Beat in the Offing for HighPoint's (HPR) Q2 Earnings?

HighPoint Resources Corporation HPR is scheduled to report second-quarter 2020 results on Aug 3, after the closing bell.

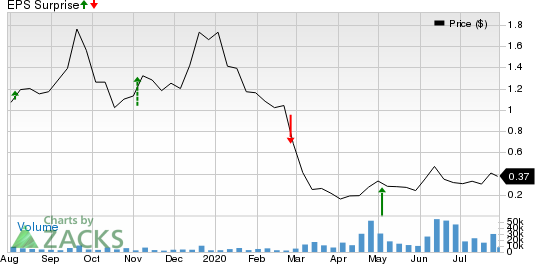

In the last reported quarter, the upstream energy company’s loss of 3 cents per share was narrower than the Zacks Consensus Estimate of a loss of 10 cents and the year-ago loss of 5 cents. The firm beat earnings estimates twice in the trailing four quarters, missed once and met on another occasion, delivering average surprise of 10.8%.

HighPoint Resources Corp Price and EPS Surprise

HIGHPOINT RESOURCES CORP price-eps-surprise | HIGHPOINT RESOURCES CORP Quote

Let’s see how things have shaped up prior to the earnings announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter earnings per share of 1 cent has witnessed one upward movement and no downward revision by firms in the past 30 days. This estimate is indicative of a 114.3% increase from the year-ago reported figure.

The Zacks Consensus Estimate for second-quarter revenues is pegged at $67.8 million, suggesting a decline of 37% from the year-ago reported figure.

What the Quantitative Model Suggests

Our proven model predicts an earnings beat for HighPoint this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: It has an Earnings ESP of +500.00%. This is because the Most Accurate Estimate for the quarter is currently pegged at 6 cents, much higher than the Zacks Consensus Estimate of a penny per share. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: HighPoint currently carries a Zacks Rank #2.

Factors Driving the Better-Than-Expected Earnings

Being primarily involved in the exploration and production of oil and natural gas, HighPoint’s earnings and revenues are directly related to commodity prices. As the demand for energy products was destroyed by coronavirus-induced lockdowns, commodity prices were significantly low in the beginning of the second quarter. The WTI Crude price averaged $16.55 per barrel in April. However, crude prices rose significantly by quarter-end, which is expected to have benefited the company’s bottom line. In June, crude prices averaged $38.31 per barrel, marking a 131.5% rise from the first month of the quarter. As HighPoint’s second-quarter total production is expected to comprise 57% crude, the price increase is expected to have provided an impetus to the firm in the low demand market environment.

Due to low prices, the company reduced planned activities at its assets. As such, its production is expected in the range of 2.5-2.6 million barrels of oil equivalent (MMBoe) for the second quarter, signaling a decline from the year-ago level of 2.84 MMBoe. However, the Zacks Consensus Estimate for natural gas production is pegged at 3,833 million cubic feet (MMcf), indicating a rise from the year-ago figure of 3,558 MMcf.

While lower overall quarterly output might have affected the company’s profits, it is anticipated to deliver an earnings beat, aided by the rise in crude price in the latter half of the quarter and higher natural gas output.

Other Stocks That Warrant a Look

Here are some other companies from the Energy space that you may also want to consider, as our model shows that these too have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Canadian Natural Resources Limited CNQ has an Earnings ESP of +6.48% and is a Zacks #2 Ranked player. The company is scheduled to release second-quarter results on Aug 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources Corporation RRC has an Earnings ESP of +2.61% and a Zacks Rank of 3. It is scheduled to report second-quarter results on Aug 3.

Bonanza Creek Energy, Inc. BCEI has an Earnings ESP of +13.66% and holds a Zacks Rank #1. It is set to report second-quarter results on Aug 6.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Bonanza Creek Energy, Inc. (BCEI) : Free Stock Analysis Report

HIGHPOINT RESOURCES CORP (HPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News