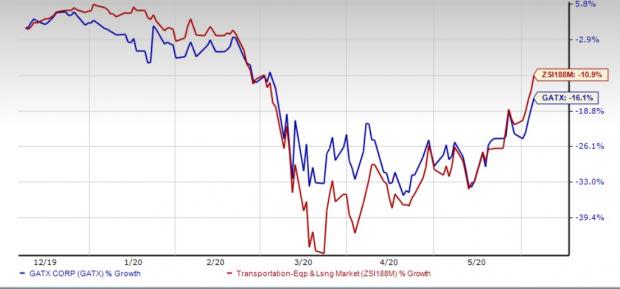

GATX Declines 16.1% in Six Months: What's Ailing the Stock?

Shares of GATX Corporation GATX have lost 16.1% in the past six months compared with the industry’s 10.9% decline.

Let’s delve deeper to unearth the reasons for the disappointing price performance.

GATX is taking a hit from the weak performance of the Rail International unit, which is a significant contributor to its top line. Evidently, segmental revenues decreased 6.1% in the March quarter due to unfavorable foreign currency fluctuations.

Moreover, softness in the North American railcar leasing market is worrisome. The railcar leasing space, after having improved in 2018, started decelerating again in 2019. The presence of railcar oversupply does not bode well. With the ongoing coronavirus-induced downturn, average lease rate on lease renewals is expected to be low in 2020. This, in turn, is likely to weigh on the Rail North America segment’s profitability.

Although the impact of the coronavirus was limited in the March quarter, a prolonged slowdown in the economy is expected to leave a substantial impact on the company’s operations and in turn, on its subsequent quarterly results. Notably, GATX suspended its previously-announced 2020 guidance due to uncertainties related to the COVID-19 pandemic.

Estimate Revisions & VGM Score

The fact that the Zacks Consensus Estimate for 2020 earnings has been revised downward to the tune of 28.7% over the past 60 days, is indicative of the negativity surrounding this Zacks Rank #5 (Strong Sell) stock. Moreover, the stock has an aggregate VGM Score of C. Notably, V stands for Value, G for Growth and M for Momentum.

Key Picks

Investors interested in in the broader Zacks Transportation sector may consider some better-ranked stocks like Air Lease Corporation AL, Ryanair Holdings plc RYAAY and Teekay Tankers Ltd. TNK, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings (three to five years) growth rate for Air Lease, Ryanair Holdings and Teekay Tankers is estimated at 3.1%, 20.5% and 3%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News