If You Had Bought AMREP (NYSE:AXR) Shares Five Years Ago You'd Have Earned 42% Returns

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the AMREP Corporation (NYSE:AXR) share price is up 42% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 5.1%.

Check out our latest analysis for AMREP

Because AMREP made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years AMREP saw its revenue shrink by 31% per year. The stock is only up 7% for each year during the period. That's pretty decent given the top line decline, and lack of profits. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

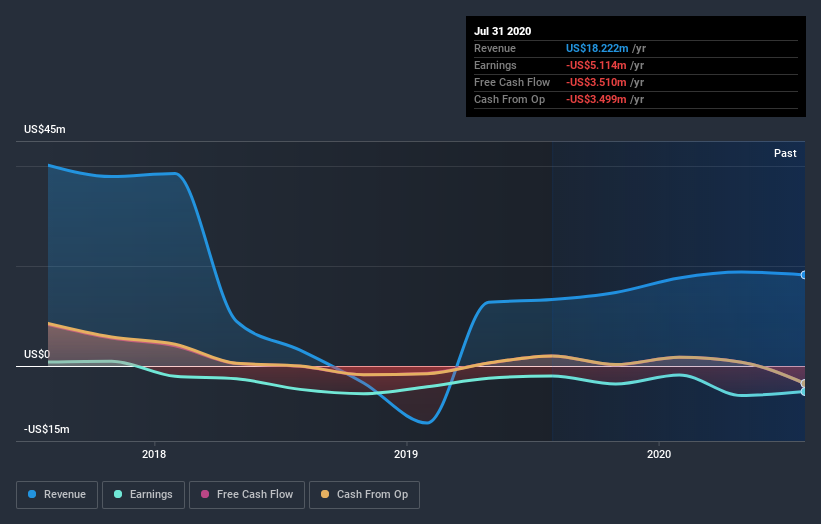

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at AMREP's financial health with this free report on its balance sheet.

A Different Perspective

AMREP provided a TSR of 5.1% over the last twelve months. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 7% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for AMREP that you should be aware of before investing here.

But note: AMREP may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News