Introducing SailPoint Technologies Holdings (NYSE:SAIL), The Stock That Zoomed 141% In The Last Year

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the SailPoint Technologies Holdings, Inc. (NYSE:SAIL) share price has soared 141% return in just a single year. Also pleasing for shareholders was the 62% gain in the last three months. SailPoint Technologies Holdings hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for SailPoint Technologies Holdings

Given that SailPoint Technologies Holdings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

SailPoint Technologies Holdings grew its revenue by 23% last year. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 141%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

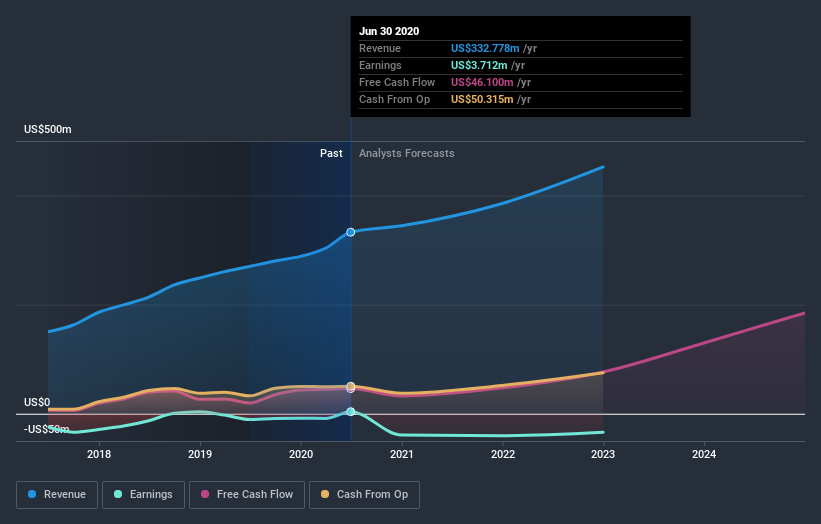

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

SailPoint Technologies Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think SailPoint Technologies Holdings will earn in the future (free analyst consensus estimates)

A Different Perspective

SailPoint Technologies Holdings shareholders should be happy with the total gain of 141% over the last twelve months. And the share price momentum remains respectable, with a gain of 62% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for SailPoint Technologies Holdings (2 are a bit concerning) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News