What You Can Learn From SJW Group's (NYSE:SJW) P/E

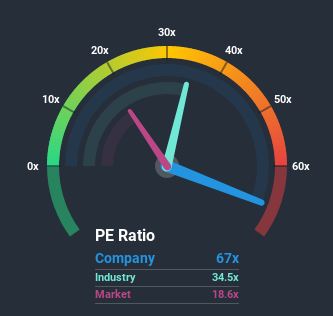

With a price-to-earnings (or "P/E") ratio of 67x SJW Group (NYSE:SJW) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for SJW Group as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for SJW Group

Want the full picture on analyst estimates for the company? Then our free report on SJW Group will help you uncover what's on the horizon.

How Is SJW Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as SJW Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 47% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 66% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 44% each year over the next three years. With the market only predicted to deliver 13% per year, the company is positioned for a stronger earnings result.

With this information, we can see why SJW Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On SJW Group's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of SJW Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for SJW Group (1 is potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on SJW Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News