Lithia Motors (LAD) Posts Q2 Earnings Beat, Hikes Payout

Lithia Motors, Inc. LAD reported adjusted earnings of $3.72 per share in second-quarter 2020, beating the Zacks Consensus Estimate of $1.51. Higher-than-expected revenues across all units led to the outperformance. The bottom line also increased 26% from the prior-year quarter’s $2.95 per share on the back of operational efficiency.

Cost of sales declined 15.9% year over year during second-quarter 2020. SG&A, as a percentage of gross profit, also declined from the prior-year level. Pretax and net profit margins improved from the year-ago levels. In fact, Lithia Motors claims to have reported the highest quarterly adjusted earnings per share in the company's history.

Total revenues fell 14.4% year over year to $2,758.6 million. However, the top line surpassed the Zacks Consensus Estimate of $2,318 million.

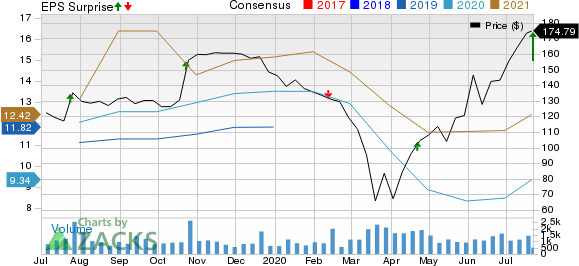

Lithia Motors, Inc. Price, Consensus and EPS Surprise

Lithia Motors, Inc. price-consensus-eps-surprise-chart | Lithia Motors, Inc. Quote

Key Takeaways

New-vehicle retail revenues declined 19.9% year over year to $1,367.8 million but topped the Zacks Consensus Estimate of $952 million. New-vehicle retail units sold decreased 24% from the prior-year quarter to 34,869. The average selling price of new-vehicle retail rose 5.4% year over to year to $39,226.

Used-vehicle retail revenues rose 3.8% year over year to $922.2 million and beat the Zacks Consensus Estimate of $515 million. Used-vehicle retail units sold grew 1.5% from the year-ago quarter to 43,505. The average selling price of used-vehicle retail improved 2.3% to $21,196 from the year-ago figure of $20,724. Meanwhile, revenues from used-vehicle wholesale contracted 37.2% year over year to $51.3 million but surpassed the consensus mark of $15.5 million.

Revenues from service, body and parts were down 17.9% from the prior-year period to $275.5 million but beat the consensus mark of $230 million. The company’s F&I (Finance & Insurance) business recorded a 3.2% year-over-year decline in revenues to $124.9 million. The metric, however, topped the consensus estimate of $81 million. Revenues from fleet and others were $16.9 million, down 78.8% year over year.

While same-store new vehicle sales decreased 23.5% year over year, same-store used vehicle retail sales increased 0.5%. Same-store revenues from the F&I business and service, body and parts unit dropped 6.9% and 20.6%, respectively.

Dividend & Financials

Despite coronavirus-led uncertainty that has prompted many companies to suspend payouts, Lithia Motors continues to pay dividends, in turn preserving shareholder value. In fact, the board recently hiked the payout by a penny per share. The dividend of 31 cents a share will be payable on Aug 28 to shareholders of record as of Aug 14, 2020.

The company had cash and cash equivalents of $120.3 million as of Jun 30, 2020. Long-term debt was $1.36 billion, marking a decrease from $1.43 billion as of Dec 31, 2019.

Zacks Rank & Other Stocks to Consider

Lithia Motors currently sports a Zacks Rank #1 (Strong Buy). Other top-ranked stocks in the auto space include Asbury Automotive Group Inc. ABG, Americas CarMart Inc. CRMT and Sonic Automotive Inc. SAH, each carrying a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Americas CarMart, Inc. (CRMT) : Free Stock Analysis Report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News