A Look At Ambarella's (NASDAQ:AMBA) CEO Remuneration

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

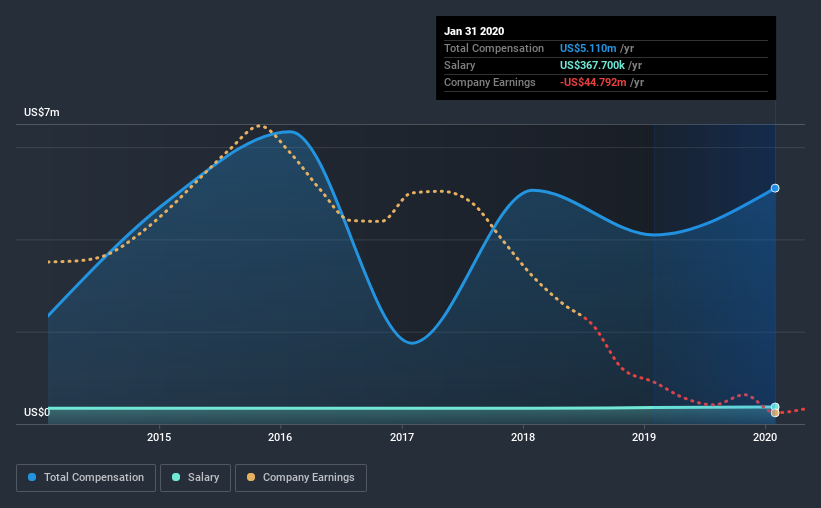

Fermi Wang has been the CEO of Ambarella, Inc. (NASDAQ:AMBA) since 2004, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Ambarella

Comparing Ambarella, Inc.'s CEO Compensation With the industry

At the time of writing, our data shows that Ambarella, Inc. has a market capitalization of US$1.7b, and reported total annual CEO compensation of US$5.1m for the year to January 2020. That's a notable increase of 25% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$368k.

On comparing similar companies from the same industry with market caps ranging from US$1.0b to US$3.2b, we found that the median CEO total compensation was US$4.2m. This suggests that Ambarella remunerates its CEO largely in line with the industry average. Furthermore, Fermi Wang directly owns US$23m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$368k | US$357k | 7% |

Other | US$4.7m | US$3.7m | 93% |

Total Compensation | US$5.1m | US$4.1m | 100% |

On an industry level, roughly 14% of total compensation represents salary and 86% is other remuneration. Ambarella sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Ambarella, Inc.'s Growth Numbers

Over the last three years, Ambarella, Inc. has shrunk its earnings per share by 110% per year. Its revenue is up 8.4% over the last year.

Few shareholders would be pleased to read that earnings have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in earnings per share. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ambarella, Inc. Been A Good Investment?

Given the total shareholder loss of 5.5% over three years, many shareholders in Ambarella, Inc. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we noted earlier, Ambarella pays its CEO in line with similar-sized companies belonging to the same industry. In the meantime, the company has reported declining earnings growth and shareholder returns over the last three years. It's tough to call out the compensation as inappropriate, but shareholders might not favor a raise before company performance improves.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 3 warning signs for Ambarella that investors should look into moving forward.

Switching gears from Ambarella, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News