Organogenesis Holdings' (NASDAQ:ORGO) Shareholders Are Down 12% On Their Shares

Organogenesis Holdings Inc. (NASDAQ:ORGO) shareholders should be happy to see the share price up 14% in the last month. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 12% in one year, under-performing the market.

See our latest analysis for Organogenesis Holdings

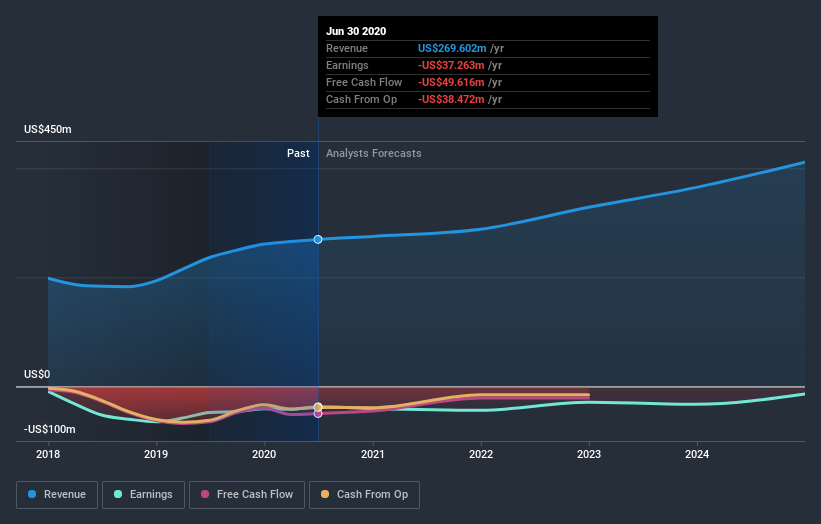

Because Organogenesis Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Organogenesis Holdings increased its revenue by 14%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 12% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Given that the market gained 25% in the last year, Organogenesis Holdings shareholders might be miffed that they lost 12%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 3.3%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Organogenesis Holdings , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News