Ovintiv Sees 650 Job Cuts in Canada & US Amid Weak Oil Demand

In a bid to rebound from the massive fall in commodity prices due to the plaguing coronavirus, Ovintiv Inc. OVV is trimming workforce by nearly 25%, indicating an approximate cutback of 650 from its total staff strength of 2,600 in Canada and the United States. This strategic move comes within a little over a year of the company’s announcement to retrench 470 employees and slash its executive leadership team by 35%.

The lay-off, effective today, happens at a time when the company braces itself for more anticipated modest growth in oil demand. Management at the company, formerly known as Encana Corporation, confirmed that its total headcount is now reduced to 2,100 comprising 1,900 personnel and 200 contractors.

Amid the ongoing declining demand and prices, oil and gas companies are being compelled to take remedial measures to safeguard their financial interest. In April, Ovintiv lowered its second-quarter 2020 capital investment projection for the second time by an additional $200 million, curtailing the total capex to $500 million for preserving liquidity amid the coronavirus-induced crisis.

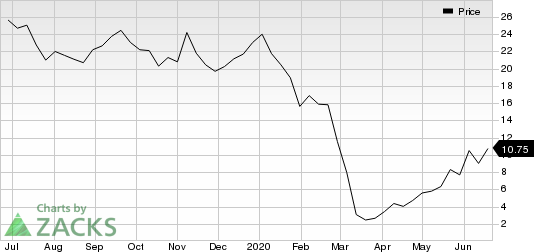

Ovintiv Inc. Price

Ovintiv Inc. price | Ovintiv Inc. Quote

Further, this energy player ensures a strong cashflow generation by streamlining oil hedges. For the second quarter, Ovintiv hedged 206,000 barrels per day at an average price of $42.09 a barrel.

Management also stated that measures adopted for capex cuts will result in abandoning 10 operated drilling rigs along with suspending additional six operated rigs in May this year. Minus these rigs, Ovintiv will be left with three functional rigs in the Permian, two in the Anadarko and two in the Montney.

Notably, this currently Zacks Rank #3 (Hold) exploration and production playeris not the only oil and gas entity to curb its expenses in recent times. Occidental Petroleum OXY, Cenovus Energy CVE and Devon Energy DVN among others also followed suit by simplifying their expenditure plan to secure cash position. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Ovintiv Inc. (OVV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News