Reflecting on Contura Energy's (NYSE:CTRA) Share Price Returns Over The Last Three Years

It is a pleasure to report that the Contura Energy, Inc. (NYSE:CTRA) is up 114% in the last quarter. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 88% in that time. Arguably, the recent bounce is to be expected after such a bad drop. But the more important question is whether the underlying business can justify a higher price still.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Contura Energy

Because Contura Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Contura Energy grew revenue at 16% per year. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 23% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

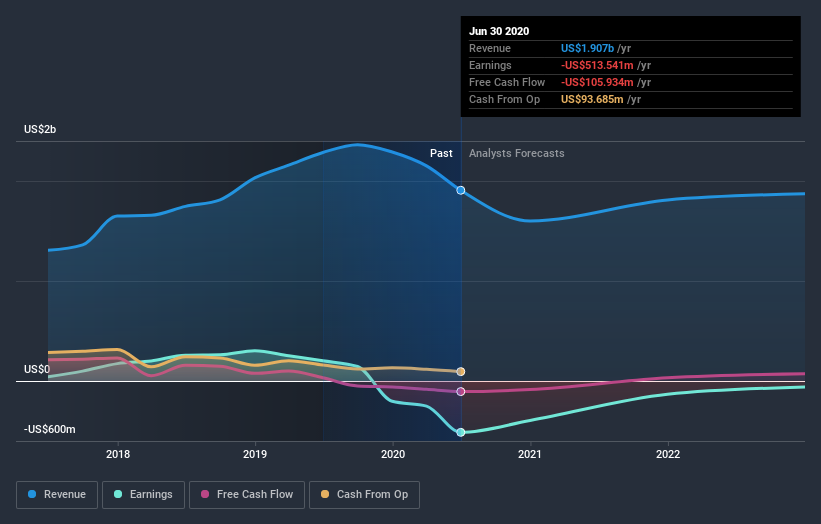

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Contura Energy stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Over the last year, Contura Energy shareholders took a loss of 67%. In contrast the market gained about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 23% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Contura Energy better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Contura Energy (including 1 which is shouldn't be ignored) .

Contura Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News