UK state pensions ranked the worst in the developed world

The British state pension is now worst in the developed world as it has fallen below Mexico and Chile, data shows.

An average worker entering the UK workforce today can expect to receive less than a third (29 per cent) of their final working salary as a basic pension income after tax, according to a report published every two years by the Organisation for Economic Co-operation and Development.

This is a reduction of around 40 per cent of what their equivalents who entered the labour market back in 2002 could have expected to receive as a percentage (47.6 per cent) of their final salary. Since the study began the UK has consistently ranked low on the list, ranking below Chile and Mexico last year, however it has never come last before.

The reason for the UK falling to the bottom of the league table is down to the earnings-related element of the state pension being removed along with the introduction of the new flat-rate pension, the OECD said.

It means UK retirees who fail to make their own pension provision face a steep income drop when they retire compared with other OECD countries.

By contrast the average worker across the OECD can expect 63 per cent of their salary as a state funded pension.

TUC general secretary Frances O’Grady said: “Working people in Britain face the biggest retirement cliff edge of any developed nation. We are letting down today’s workers if we can’t provide them with a decent retirement income.”

The OECD said that like other countries, the UK is “ageing quickly” and the number of people aged 65 and over for every 100 people of working age will rise from about 30 today to 48 in 2050.

It said: “Already today, poverty among older people is high in the United Kingdom: among those aged 75 and over 18.5 per cent have incomes below the poverty line, most of them women. The main reason is the low level of the state pension.”

The new simplified state pension should improve matters, but there is a long transition period, the report said. While those who are able to save, buy their own home and put money in private pensions may have relatively good incomes, retirees without these types of revenue “are left with few resources,” it said.

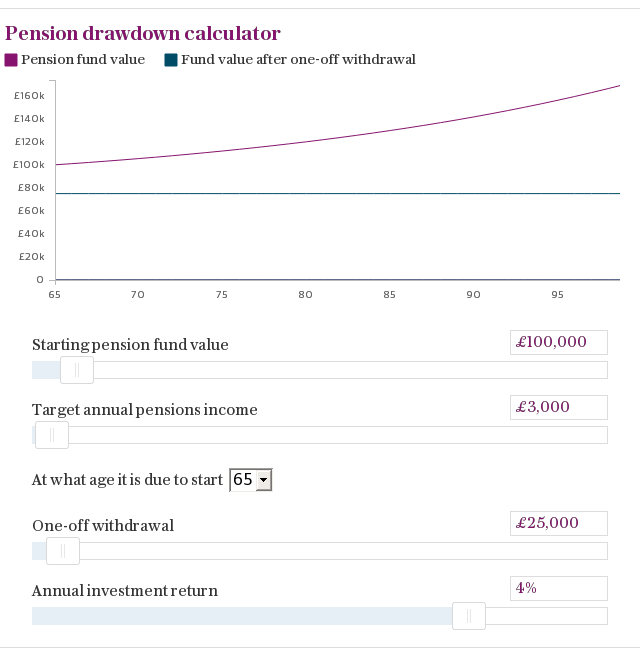

The report also suggested that the pension freedoms and the rigidity of the state pension, which cannot be accessed until people reach a certain age, could increase inequality in the UK. It said recent changes enabling older people to withdraw chunks of cash from their retirement pots could lead to further inequality “as not all will be able to finance retiring earlier”.

The OECD also warned that some people using the pension freedoms may be inclined to spend their lump sums early or underestimate their life expectancy, leaving them with limited resources at a very old age.

In July, it was announced that the the state pension age in the UK will rise from 67 to 68 between 2037 and 2039, seven years earlier than previously planned.

The OECD promotes policies aiming to improve the economic and social wellbeing of people globally.

A DWP spokesperson said: “We have taken decisive action to address our changing population through a new, generous State Pension, retaining the Triple Lock and protecting the poorest through Pension Credit - reducing pensioner poverty close to historically low levels.

“But there’s always more to do. Thanks to automatic enrolment, around 11 million people will be newly saving or saving more into a workplace pension by 2018.”

Yahoo News

Yahoo News