Why You Should Buy EOG Resources (EOG) Stock Right Away

EOG Resources, Inc. EOG stock appears to be a solid bet now, based on strong fundamentals and compelling business prospects.

Headquartered in Houston, TX, EOG Resources is primarily involved in exploring and producing oil and natural gas. This leading upstream energy player’s operations are located in the United States and abroad. It employs technologies like horizontal drilling and advanced completion techniques to maximize production from wells. The company has recorded an earnings growth rate of 10.3% in the past five years, outperforming the industry’s 1.2% growth. This momentum is likely to continue, as indicated by EOG Resources’ projected earnings per share growth of 9.4% for the next five years.

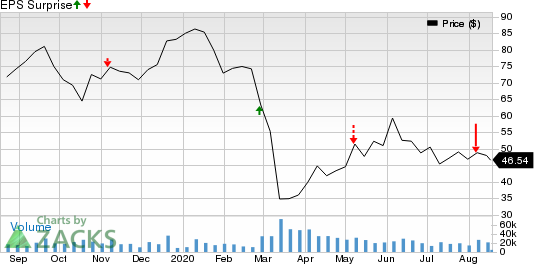

EOG Resources, Inc. Price and EPS Surprise

EOG Resources, Inc. price-eps-surprise | EOG Resources, Inc. Quote

Let's see what makes this Zacks Rank #2 (Buy) stock an attractive investment option at the moment.

Growth Drivers

The upstream energy player has an attractive growth profile, huge inventory of drilling opportunities, upper quartile returns and a disciplined management team. The company has significant acreages in oil shale plays like Permian, Bakken and Eagle Ford. Most importantly, EOG Resources is among the leading players in the Bakken play and the largest in the Eagle Ford. The upstream player’s extensive reach to these key shale resources will likely support long-term production growth.

In the promising shale plays, EOG Resources has identified 10,500 undrilled premium wells that could provide access to 10.2 billion barrels of oil equivalent estimated potential reserves. In the Eagle Ford alone, the company identified 1,900 undrilled premium locations with 3.2 billion barrels of oil equivalent of estimated potential reserves.

Even though EOG Resources curtailed production due to low oil prices, stemming from coronavirus-induced lockdowns and exhausted storages, it brought back a significant portion of the output following oil price recovery. The company expects 2020 production in the range of 730.1-765.9 thousand barrels of oil equivalent per day (MBoe/d). Third-quarter output will likely be in the band of 676.1-711.7 MBoe/d.

Total operating expenses decreased to $2,189.9 million in the second quarter from $3,566.9 million a year ago. Moreover, the company increased well cost savings target for this year to 12% from 8% announced earlier.

Its balance sheet is significantly less levered than the composite stocks belonging to the industry. In fact, the company’s debt-to-capitalization ratio has consistently been lower than the industry over the past five years. Notably, its cash balance of $2,416.5 million is more than sufficient to pay the current debt of only $21.1 million. It had a long-term debt of $5,703.1 million at second quarter-end.

Other Stocks to Consider

Other top-ranked players in the energy space include Noble Energy, Inc. NBL, Murphy Oil Corporation MUR and Concho Resources Inc. CXO, each holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Noble Energy’s bottom line for 2021 is expected to surge 57.9% year over year.

Murphy Oil’s bottom line for 2021 is expected to rise 4% year over year.

Concho Resources’ bottom line for 2020 is expected to rise 36.1% year over year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Noble Energy Inc. (NBL) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News