Why It Might Not Make Sense To Buy Xperi Holding Corporation (NASDAQ:XPER) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Xperi Holding Corporation (NASDAQ:XPER) is about to trade ex-dividend in the next three days. Ex-dividend means that investors that purchase the stock on or after the 28th of August will not receive this dividend, which will be paid on the 21st of September.

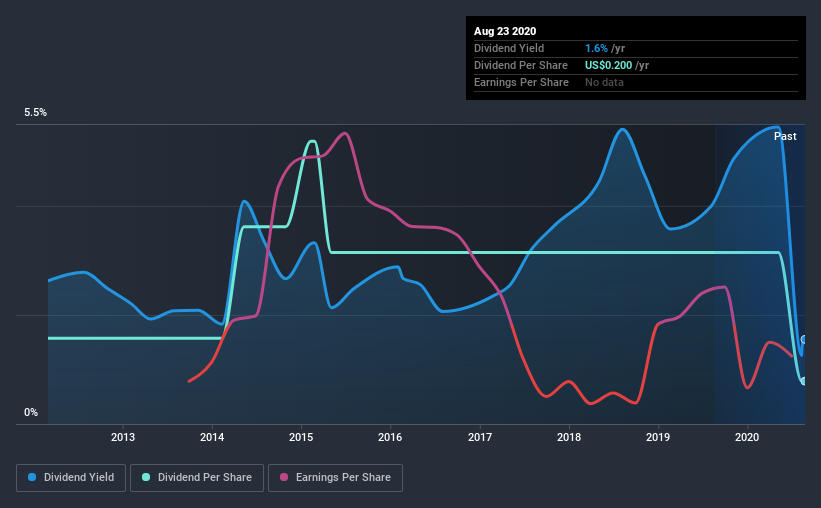

Xperi Holding's upcoming dividend is US$0.05 a share, following on from the last 12 months, when the company distributed a total of US$0.20 per share to shareholders. Last year's total dividend payments show that Xperi Holding has a trailing yield of 1.6% on the current share price of $12.89. If you buy this business for its dividend, you should have an idea of whether Xperi Holding's dividend is reliable and sustainable. So we need to investigate whether Xperi Holding can afford its dividend, and if the dividend could grow.

View our latest analysis for Xperi Holding

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Xperi Holding lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If Xperi Holding didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. It distributed 25% of its free cash flow as dividends, a comfortable payout level for most companies.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Xperi Holding reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Xperi Holding has seen its dividend decline 8.3% per annum on average over the past eight years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Get our latest analysis on Xperi Holding's balance sheet health here.

To Sum It Up

Should investors buy Xperi Holding for the upcoming dividend? It's hard to get used to Xperi Holding paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. Bottom line: Xperi Holding has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

So if you're still interested in Xperi Holding despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. For instance, we've identified 3 warning signs for Xperi Holding (2 are concerning) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News